amazon flex taxes canada

Amazon Flex is a program where independent contractors called delivery partners deliver Amazon orders. Knowing your tax write offs can be a good way to keep that income in your.

How To File Amazon Flex 1099 Taxes The Easy Way

Fill out your Schedule C.

. Whatever drives you get closer to your goals with Amazon Flex. Amazon will not withhold taxes on the earnings of Canadian tax residents. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone.

If you use an iPhone set up trust for the app. If your products are located outside of Canada before you ship them to a Canadian address or to our fulfilment centre. Disable or uninstall any app that changes the lighting on your phone based on the time of day.

Make INR 120-140hour delivering packages with Amazon Flex. You can plan your week by reserving blocks in advance or picking them each day based on your availability. Well guide you every step of the way from sign up to making your first delivery to on-road support.

Hourly rate plus per package full family benefits and a pension that pays 60 of your wage for life after 20 years. Under Canada tax jurisdictions settings add your Canada tax registrations numbers to activate each of them. To avoid the estimated tax penalty you must pay one of the above percentages through a combination of estimated tax payments and withholding.

The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year. When prompted tap Trust. Go to the Tax Exemption Wizard.

Amazon is excited to welcome you to the Amazon Flex program and hope that you enjoy being your own boss and running your own business by using the Amazon Flex app. Posted by 5 years ago. With every offer youll see your expected earnings and how long your block is likely.

Get started now to reserve blocks in advance or pick them daily based on your schedule. 12 tax write offs for Amazon Flex drivers. Delivery is easy with the Amazon Flex app.

This report is useful when you are filing your sales taxes with. Select Sign in with Amazon. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am.

Go to your phones My Files or Downloads folder and tap the Amazon Flex icon to install. Adjust your work not your life. Tap Forgot password and follow the instructions to receive assistance.

AGI over 150000 75000 if married filing separate 100 of current year taxes. The following examples illustrate how Canadian sales tax may be calculated on your selling fees. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone.

Choose the blocks that fit your schedule then get back. Amazon flex business code. To meet the requirements for a 1099-K you must have both 20000 in total sales and 200 individual transactions.

Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. We know how valuable your time is. Whats the downside as union dues are tax deductible.

This new legislation takes effect on April 1 2021. With Amazon Flex you work only when you want to. The amount of tax and National Insurance youll pay will depend on how much money is left over after deducting your flex expenses tax allowances and reliefs.

The Amazon Tax Exemption Wizard takes you through a self-guided process of enrolment. Income tax starts at 20 on all your income not just from amazon over 12500 and 40 over 50000. 110 of prior year taxes.

To make sure you do this right just look through your bank statements and add up your direct deposits from Amazon Flex. First reserve a block. As an independent contractor.

Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. Your 1099-NEC isnt the only tax form youll use to file. If you sell products in Canada you are responsible for paying any applicable taxes destination duties and customs clearance fees before your product can be sold to Canadian residents or stored in an Amazon fulfilment centre.

Once youve downloaded the app set up your account and passed a background check you can look for delivery opportunities that are convenient for you. 100 of prior year taxes. Delivery Partners can schedule work ahead or.

Marketplace Tax Collection applies to all products from all sellers on all Amazon marketplaces when an order is being shipped to. The tax calculation service fee will be 29 of the tax amount calculated on your products and is non-refundable. Your sales tax report contains all the tax calculation details jurisdiction rate ship tofrom etc used to make a tax calculation on every item sold in an order.

Turn on Location Settings. Go to Settings General Profiles or Device Management. Make sure that you have all the necessary information for enrolment.

Youll need to declare your amazon flex taxes under the rules of HMRC self-assessment. Unfortunately youll still have to report your income to the IRS even without a 1099. Legislation was enacted in British Columbia BC Canada that requires non-residents to apply Provincial Sales Tax BC PST on specific cross-border digital services supplied to BC customers who utilize the service for their own purposes eg are not resellers.

How to Calculate Your Tax. Driving for Amazon flex can be a good way to earn supplemental income. Class 2 National Insurance is paid as a set weekly.

In Canada flex drivers are employees by law and can unionize. Knowing your tax write offs can be a good way to keep that income in your pocket. Based on the destination of your order Amazon may be legally obligated to calculate collect and remit applicable national state or local sales or use taxes goods and services taxes GST or value added taxes VAT collectively referred to as Taxes.

With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes. With Amazon Flex you work only when you want to. Open the Amazon Flex app to search for available delivery blocks in your area.

Gig Economy Masters Course. Our Amazon Tax Exemption Program ATEP supports tax-exempt purchases for sales sold by Amazon its affiliates and participating independent third-party sellers. Ad We know how valuable your time is.

Be your own boss. 90 of current year taxes. If you join us as an Amazon Flex Delivery Partner you can build your own schedule and earn money when its convenient for you.

Welcome to Amazon Flex an innovative new service offering you the opportunity to deliver Amazon packages through the Amazon Flex app. If your business is located in Quebec and your sales tax rate is 14975 rate may vary and you sell an item with a total price of 20 with a 15 referral fee fee may vary based on product type we will collect and remit 045 tax on the 300 referral fee to comply with federal and. Increase Your Earnings.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Waterproof Bluetooth Speaker In 2022 Shower Bluetooth Speaker Shower Speaker Waterproof Bluetooth Speaker

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Create Professional Fake Utility Bills Novelty Utility Bill

Philippians 4 8 Bible Quote Print Bible Verse Wall Art Poster Christian Room Decor Scripture Wall Art Typographic Ipphilippians 4 8

Canada Rules Amazon Flex Drivers Are Employees And Can Unionize Flex Drivers Can Do Way Better R Amazonflexdrivers

How Amazon Flex Delivery Drivers Get Paid And What It S Really Like

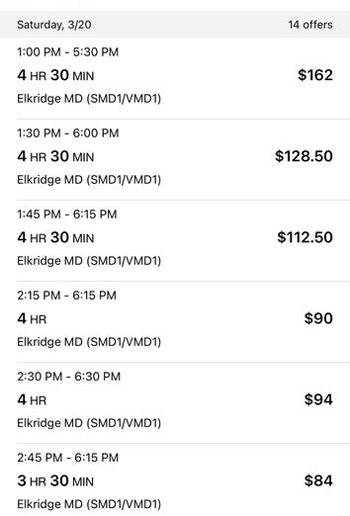

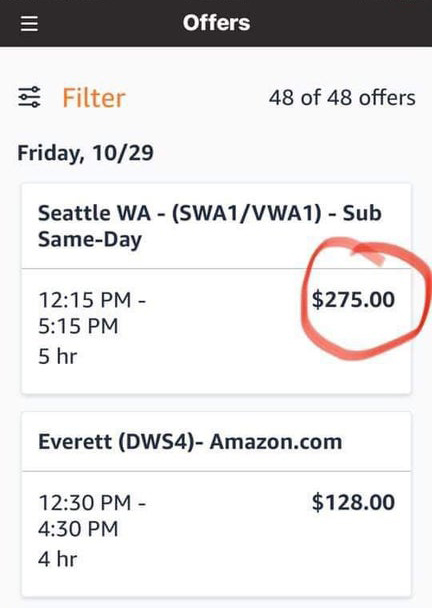

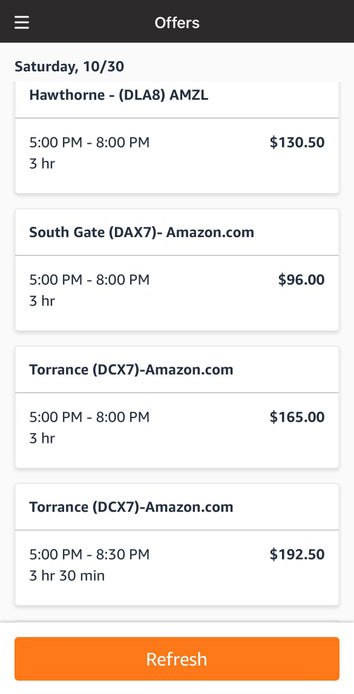

Amazon Flex Surge Drivers See 275 Offers And 55 Hour During Peak Season Ridesharing Driver

Curad Fabric Adhesive Knuckle Bandages Finger Bandages For Knuckles Pack Of 100 Natural Adhesive Bandage Finger Bandages

Bank Of Nova Scotia Login Scotiabank Canada

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To Do Taxes For Amazon Flex Youtube

How Much Do Amazon Flex Drivers Make Youtube

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Flex Surge Drivers See 275 Offers And 55 Hour During Peak Season Ridesharing Driver